Aside from FICA tax, it is likely that you also paid a Medicare tax on earnings from your employment. Medicare is the federal health insurance program primarily for people who are 65 or older. Similar to Social Security, Medicare is an entitlement program. Most U.S. citizens earn the right to enroll in Medicare by working and paying their taxes for a minimum required period.

Even if you did not work long enough to be entitled to Medicare benefits, you may still be eligible to enroll, but you might have to pay more. The Medicare Program is administered by the Centers for Medicare & Medicaid Services (CMS), a division of the U.S. Department of Health & Human Services (HHS).

The Four Parts of the Medicare Program

There are four different parts to the Medicare program. Parts A and B are often referred to as Original Medicare. Medicare Part C, or Medicare Advantage, is private health insurance, while Medicare Part D offers coverage for prescription drugs.

Medicare Part A

Medicare Part A is hospital insurance that covers inpatient hospital care, skilled nursing care facility services for a limited time, some home healthcare services, and hospice care.

Most Medicare Part A beneficiaries receive coverage under this part of Original Medicare without having to pay a monthly premium; this is called “premium-free Part A.” Generally, if you’ve worked at least 10 years (40 quarters) and paid Medicare taxes while you worked, you are eligible for premium-free Part A. Otherwise, you have to pay a monthly premium.

Medicare Part A typically does not fully cover your hospital bill; you will probably be responsible for a share of the cost. Also, you must first pay a deductible before Medicare benefits kick in. Medicare then pays 100% of your costs for up to 60 days in a hospital or up to 20 days in a skilled nursing facility. After that, you share in the costs by paying a flat amount up to the maximum number of covered days, which are 90 days in a hospital and 100 days in a skilled nursing facility. Medicare also covers a limited number of “lifetime reserve days.” These are days you stay in a hospital beyond 90 days in a row. You get a total of 60 lifetime reserve days.

Medicare Part B

Medicare Part B is medical insurance. Part B benefits cover outpatient hospital care, and certain non-hospital medical expenses like doctors’ office visits, blood tests, x-rays, diabetic screenings and supplies. You pay a monthly premium for this part of Original Medicare. The premium can be higher for people with high incomes. A different government program, Medicaid, can help cover Medicare Part B premiums for low-income beneficiaries.

Medicare Part B beneficiaries are typically responsible for a portion of their health care costs. Each year you will have to pay a deductible before your Medicare Part B benefits start, and then you will generally pay 20% of the bill when you go to a participating Medicare doctor. Medicare pays the entire cost of many lab tests and services requested by your doctor.

Except in certain circumstances, Medicare will not pay for the following items, so you should include provision in your budget to pay for them:

- Routine dental care

- Hearing aids

- Routine eye examinations

- Glasses and contacts

- Cosmetic surgery

- Routine foot care

- Acupuncture

- Care received outside the U.S.

- Personal care

Medicare Part C

Medicare Part C, or Medicare Advantage, is an alternative to Original Medicare, and is offered by private insurance companies contracted through CMS. Enrolling into a Medicare Advantage plan is optional, but to obtain this private insurance, you must also have Original Medicare, Part A and Part B. You also may need to continue to pay your Part B premium.

Medicare Advantage plans must provide all Medicare Part A and Medicare Part B benefits (except hospice care); plans may also include additional benefits, which vary among the individual private health insurers.

Many Medicare Advantage plans include prescription drug coverage, known as Medicare Advantage Prescription Drug plans. Some plans might offer a lower deductible, while also allowing you to pay a smaller share of the remaining costs. Medicare Advantage plans may cover certain health care services that Original Medicare Part A and Part B do not cover, such as eye exams, hearing aids, and dental care. Some may cover health care received while traveling outside the United States.

Medicare Part D

Medicare Part D is optional prescription drug coverage. Medicare Part D is available as a stand-alone prescription drug plan through private insurance companies, and the monthly fee varies among insurers. You will share in the costs of your prescription drugs according to the specific plan in which you are enrolled. Those costs can include a deductible, a flat co-payment amount, or a percentage of the full drug cost (called “coinsurance”).

If you want prescription drug coverage, you can get it through a Medicare Advantage Prescription Drug plan if there is one in your area that offers this coverage. If you have limited income and cannot afford your medications even though you receive Medicare Part D benefits, you may qualify for the Extra Help program which offers financial assistance for your monthly premium, deductible, co-payment, or coinsurance.

Medicare Has Enrollment Deadlines – Do not be Late, or it will Cost You

If you sign up for Social Security benefits by the age of 65, you will be automatically enrolled in Medicare parts A and B, and coverage will begin the month you turn 65. But if you have not claimed Social Security by age 65, you will need to take action to sign up for Medicare.

You can initially sign up for Medicare Part A hospital insurance and Medicare Part B medical insurance during the seven-month period that begins three months before the month in which you turn 65. Your coverage can begin as early as the first day of the month you turn 65, or the first day of the prior month if your birthday falls on the first of the month. Medicare Advantage Plans have the same initial enrollment period.

If you do not enroll in Medicare during the initial enrollment period around your 65th birthday, you can sign up between January 1 and March 31 each year for coverage that will begin on July 1. However, you could be charged a late enrollment penalty when your benefits start. Monthly Part B premiums increase by 10 percent for each 12-month period you delay signing up for Medicare after becoming eligible for benefits. The penalty exists to encourage people to enroll in insurance as soon as they are eligible as opposed to waiting until they have some kind of negative health event. That way they are more likely to be paying premiums into the program before they start drawing benefits.

Other deadline rules may apply if your spouse is still working and has group insurance coverage provided by their employer. Also, Medicare Part D prescription drug coverage has the same initial enrollment period of seven months around your 65th birthday as Medicare Parts A and B, but the penalty is calculated differently. The late enrollment penalty is applied if you go 63 or more days without prescription drug coverage after becoming eligible for Medicare. You should check the Medicare website for current rules.

Medigap Plans

Medigap policies are private supplemental insurance plans that can be used to pay for some of Medicare’s cost-sharing requirements and sometimes services that Original Medicare does not cover.

The Medigap initial enrollment period differs from that of the other parts of Medicare. There is a six-month period that begins when you are 65 or older and enrolled in Medicare Part B. During this initial enrollment period, private health insurance companies are required to sell applicants a Medigap policy regardless of health conditions; you are entitled to get a Medigap plan without substantial underwriting.

After this initial enrollment period, insurance companies may use medical underwriting to determine how much to charge for the policy, and they can reject patients they do not want to cover. You will no longer be guaranteed the ability to buy a Medigap policy, or you could be charged significantly more if you have any health conditions.

You might not be able to switch into a new Medigap plan later, so you should choose carefully during the initial enrollment period. Once you have been on a supplemental plan for a while, if you get sick, the plan that you are on must keep you. However, another plan does not have to accept you.

Personal Development Goals

Personal Development Goals

Bedrooms Designed for Aging in Place

Bedrooms Designed for Aging in Place Furniture

Furniture Kitchens Designed for Aging in Place

Kitchens Designed for Aging in Place Lighting and Light Switches

Lighting and Light Switches

Assisting With Functional Mobility

Assisting With Functional Mobility Bath and Shower Mobility Aids

Bath and Shower Mobility Aids Bedroom Mobility Aids

Bedroom Mobility Aids Assisting with Personal Grooming and Hygiene

Assisting with Personal Grooming and Hygiene Caring for Someone With Incontinence

Caring for Someone With Incontinence Helping People To Cope with Alzheimer’s and Dementia

Helping People To Cope with Alzheimer’s and Dementia Helping With Bill Paying

Helping With Bill Paying Home Cleaning Services

Home Cleaning Services Offering Companionship

Offering Companionship Providing Medication Reminders

Providing Medication Reminders Providing Transportation

Providing Transportation Running Errands

Running Errands

Burn Care

Burn Care Mental Health Rehabilitaion

Mental Health Rehabilitaion

Canes

Canes Chair Lifts / Stair Lifts

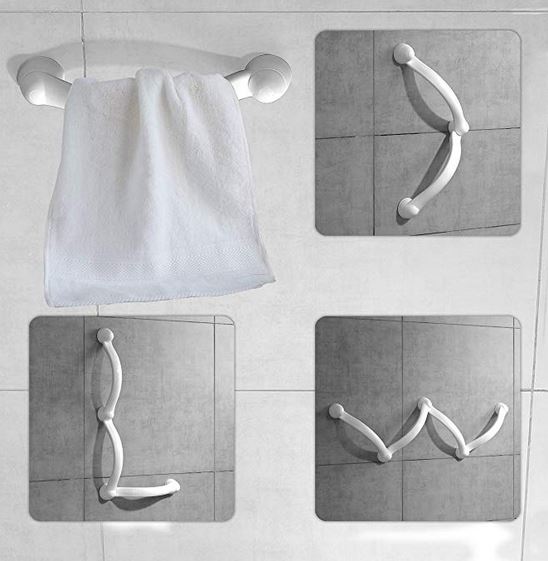

Chair Lifts / Stair Lifts Grab Bars

Grab Bars Knee Scooters / Knee Walkers

Knee Scooters / Knee Walkers Ramps

Ramps Scooters

Scooters Transfer belts / pads / equipment

Transfer belts / pads / equipment Walkers and Rollaters

Walkers and Rollaters Wheelchairs and Mobile Chairs

Wheelchairs and Mobile Chairs

Accounting and Tax

Accounting and Tax Books-Seminars-Courses

Books-Seminars-Courses

ASSISTED LIVING

ASSISTED LIVING Assisted Living Facilities

Assisted Living Facilities Cohousing Communities

Cohousing Communities Manufactured Housing Communities

Manufactured Housing Communities Naturally Occurring Retirement Communities (NORCs)

Naturally Occurring Retirement Communities (NORCs) Personal Residence LIving Independetly

Personal Residence LIving Independetly Accessory Dwelling Units

Accessory Dwelling Units Continuing Care Retirement Communities

Continuing Care Retirement Communities Multigenerational Households

Multigenerational Households