Savings and investment options abound. As you age you may want to adjust your savings and investment strategy to take into account expected changes in your employment or business earnings, expenses, and lifestyle. It may make sense for you to add a financial advisor to your retirement team.

Financial Advisors

Financial advisors generally fall into one of three general categories:

- Investment Adviser Representatives – Employees of a Registered Investment Adviser, regulated by individual states or the SEC. These advisors must always act as fiduciaries in the best interests of their clients.

- Registered Representatives – Employees of a Broker-Dealer regulated by FINRA. These advisors are held to a suitability standard when making recommendations to clients (more on this later).

- Dual Registered – Employees of Hybrid firms that can altenate between being an Investment Adviser Representative or a Registered Representative as wanted or needed.

Only individuals that act as Investment Advisor Representatives all of the time are true fiduciaries that must always act in the best interest of their clients.

Fiduciary Advisors

Fiduciary advisory must act in their client’s best interest and always place the interests of the client above all else.

Fiduciary advisors operate on a fee-only basis and receive compensation solely from fees charged to their clients. They receive no commissions from investments, products, or services they may recommend. In addition, a fiduciary advisor must clearly disclose conflicts of interest when and if they arise.

Non-Fiduciary Advisors

These individuals are held to a “suitability” standard when making recommendations to a client. Under this standard, brokers have a great deal of latitude when doling out advice to a client. As long as an investment is suitable to the client’s risk profile, time frame, and objectives they may recommend the product irrespective of better and/or most cost-effective alternatives. This creates the problem of brokers selecting products and services that pay them favorably while ignoring products that may be better for the client which don’t compensate the broker as well.

This is not to say that all individuals acting as brokers are trying to take advantage of their clients. Most acting in this capacity attempt to do right by the people they serve. However, this model may lead some to offer less than ideal advice for a client. The exists a potential conflict of interest wherein the advisor’s loyalty to their employer broker-dealer and their own desire to increase commissions may not always result in optimal advice for any given clients.

Personal Development Goals

Personal Development Goals

Bedrooms Designed for Aging in Place

Bedrooms Designed for Aging in Place Furniture

Furniture Kitchens Designed for Aging in Place

Kitchens Designed for Aging in Place Lighting and Light Switches

Lighting and Light Switches

Assisting With Functional Mobility

Assisting With Functional Mobility Bath and Shower Mobility Aids

Bath and Shower Mobility Aids Bedroom Mobility Aids

Bedroom Mobility Aids Assisting with Personal Grooming and Hygiene

Assisting with Personal Grooming and Hygiene Caring for Someone With Incontinence

Caring for Someone With Incontinence Helping People To Cope with Alzheimer’s and Dementia

Helping People To Cope with Alzheimer’s and Dementia Helping With Bill Paying

Helping With Bill Paying Home Cleaning Services

Home Cleaning Services Offering Companionship

Offering Companionship Providing Medication Reminders

Providing Medication Reminders Providing Transportation

Providing Transportation Running Errands

Running Errands

Burn Care

Burn Care Mental Health Rehabilitaion

Mental Health Rehabilitaion

Canes

Canes Chair Lifts / Stair Lifts

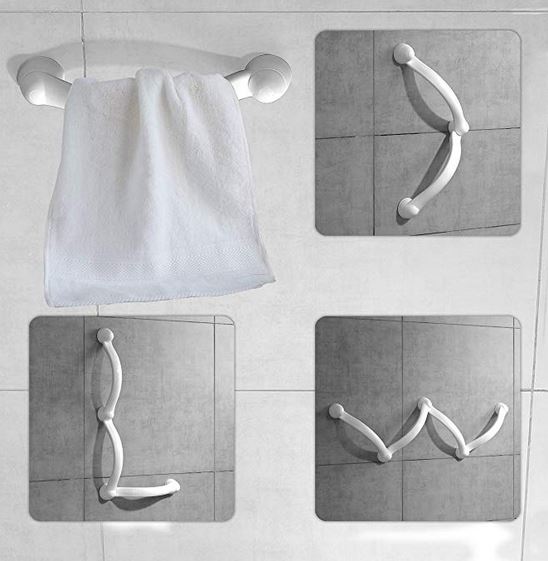

Chair Lifts / Stair Lifts Grab Bars

Grab Bars Knee Scooters / Knee Walkers

Knee Scooters / Knee Walkers Ramps

Ramps Scooters

Scooters Transfer belts / pads / equipment

Transfer belts / pads / equipment Walkers and Rollaters

Walkers and Rollaters Wheelchairs and Mobile Chairs

Wheelchairs and Mobile Chairs

Accounting and Tax

Accounting and Tax Books-Seminars-Courses

Books-Seminars-Courses

ASSISTED LIVING

ASSISTED LIVING Assisted Living Facilities

Assisted Living Facilities Cohousing Communities

Cohousing Communities Manufactured Housing Communities

Manufactured Housing Communities Naturally Occurring Retirement Communities (NORCs)

Naturally Occurring Retirement Communities (NORCs) Personal Residence LIving Independetly

Personal Residence LIving Independetly Accessory Dwelling Units

Accessory Dwelling Units Continuing Care Retirement Communities

Continuing Care Retirement Communities Multigenerational Households

Multigenerational Households