Depending on where you want to locate, a manufactured home community may be a good choice for you. Many different options and communities exist to suit your interests and budget.

What is Manufactured Housing?

Manufactured homes are prefabricated in a factory and then transported to a home site. The manufactured housing industry distinguishes several categories of homes, including modular homes, panelized homes, pre-cut homes, manufactured homes, and mobile homes. Here we limit the discussion to manufactured homes.

Manufactured Homes

The term “manufactured home” is governed by law. The HUD code governing manufactured home (“MH”) construction went into effect June 15, 1976. Manufactured homes are built as dwelling units of at least 320 square feet in size with a permanent chassis to assure the initial and continued transportability of the home.

Manufactured homes may be single-section homes (called single-sides) or multi-section homes, with two or more sections pieced together at the home site to comprise the whole (called double-wides, or multi-wides).

The original focus of manufactured homes was their ability to relocate easily. Over time that focus changed, as units grew in size, making mobility more difficult. Today, when a factory-built MH is moved to a location, it is usually stays there permanently. Moving the homes is expensive, as is disconnecting and reconnecting utilities. Homes moved into or out MH communities are also subject to entry and exit fees and potential restrictions on removal.

Manufactured Homes May Be Treated as Personal Property or Real Estate

When a new manufactured home is purchased, it is titled as personal property, not real estate. If the home is placed on land owned by the homeowner, and the owner meets certain state-specific requirements for foundation and the filing of paperwork, the home can be re-titled as real estate. Otherwise the home remains personal property, even if the home owner also owns the land under the home.

By owning the land beneath their homes and filing to convert the homes to real estate, manufactured homeowners increase the likelihood of realizing price appreciation. However, the flip side is that manufactured homeowners become subject property taxes on the structure itself, if it is re-titled as real estate.

Manufacturing Homes are Less Expensive than Site-Built Homes

Manufactured homes are about 30% less expensive per square foot than comparable site-built homes. This is true even if the land on which the home sits is considered as part of the cost. The efficiencies and cost savings of factory-building the homes far outweigh the costs of sales, transport, and set-up of the completed homes.

The life expectancy of modern manufactured homes equals that of comparable site-built homes. Manufactured housing that is properly installed following the HUD construction code is as safe and storm-resistant as site-built homes.

Manufactured Housing Communities

Many manufactured homes are placed either in a manufactured housing community, or on private land owned by third parties. Homeowners pay the community or land owners what is known as a lot rent for the land under the homes.

In some manufactured housing communities, the residents lease the land from a resident-owned cooperative or community land trust. Under this type of structure, residents indirectly lease from themselves, gaining enhanced stability and security.

In either scenario, the homes are still treated as personal property.

Costs of Financing for Manufactured Housing Depends on Titling

Lenders view manufactured homes titled as personal property as riskier collateral than homes titled as real estate. Lenders limit the terms of MH personal property loans to shorter repayment periods (10 to 20 years), and subject the borrowers to higher interest rates.

Restrictions on Placement of Manufactured Homes

Placement of new manufactured homes is generally subject to zoning restrictions. Such restrictions include:

- Limitations on the number and density of homes permitted on any given site,

- Minimum size requirements,

- Limitations on exterior colors and finishes, and

- Foundation mandates.

Many jurisdictions do not allow the placement of any additional manufactured homes. Others strongly limit or forbid single-wide models, which tend to depreciate in value more rapidly than modern double-wide models.

Pre-June 1976 Mobile Homes Versus Newer Manufactured Homes

The derogatory concept of a “trailer park” typically refers to older single-wide homes, occupying small, rented lots and remaining on wheels. This is true even if the home stays in place for decades. Modern homes do not conform to this image and can be identical in appearance to site-built homes.

Newer homes, particularly double-wide models, tend to be built to much higher standards than their predecessors. This has led to a reduction in the rate of value depreciation of many used manufactured homes.

Most manufactured housing communities contain a combination of older mobile homes and newer manufactured homes. Newer communities contain just manufactured homes (built after June 15, 1976), and older communities might hold entirely mobile homes.

In communities, newer manufactured homes gradually replace older ones. This usually occurs when a new buyer comes in to the community and, although they like a given lot, want to put a newer home on it.

Manufactured Housing Community Considerations

If your are considering acquiring a used manufactured home in a MH community, or acquiring a new home and moving it into a MH community, you should consider certain factors.

- Check out land rents in any community you visit. Land rents can be high, and may continue to increase, as land under the home becomes more valuable and property taxes that must be recouped by the owner are passed on to you.

- Many manufactured housing communities were originally built outside the city limits. The land beneath them may be zoned commercial rather than single-family residential. Eventually, that land may become very valuable.

If the owner sells the land, residents may be forced to move. As a lessee, you have only limited control over what is going to happen to the land.

- There is lack of substantive landlord-tenant statutes to regulate the relationship between landlords and manufactured home owners. This means landlords have few non-market restrictions against raising rents. Increasing monthly rents can raise the value of the community if the landlord wants to sell, and so they may have incentive to do so.

- The potential exists for predatory behavior by unscrupulous landlords. Some may purposely raise rents high enough that they economically evict homeowners. Given the cost of moving homes, the owners are forced abandon or sell the home to the landlord for little. The landlord could then potentionally profit by reselling or renting out the home.

Residents can get stuck in place because it is too expensive to move their homes. Most communities will not accept a manufactured home that is more than a few years old, so there are limited options on locations to which residents can move the home even if they could afford to do so.

It is difficult to sell a unit in a community where the rents continue to go up and the homeowners have no way to address the increases.

Land Co-Ops

Land co-ops owned by the residents have popped up to address some of the land-lease risks. Low share value co-ops are the easiest for homeowners to buy into because they do not have to come up with a lot of money for a share, and the homes trade at market value. Because there is some contributory value to the home from the land itself, home values will improve over time. In a limited equity housing cooperative:

These co-op arrangements also give homeowners more control over lot rents, provide a logical solution to community upkeep, and contribute to community stability by minimizing the threat of redevelopment at the hands of profit-motivated corporate landlords.

How to Search for a MH Community

Putting aside the likelihood that you have a resident-owned community in your area, here are some MH community house-hunting tips:

- Find a community owned by a nonprofit agency or housing authority – their land is secure and you know what your rent is going to be. In the case of a housing authority, they can charge only 30 percent of your income for rent because they receive government subsidies.

- Look for a long-term lease – some communities offer 5-, 10- or even 20-year leases to reassure tenants and attract new residents. Study the lease carefully, and run it by an attorney before you sign.

- Ask about a homeowner’s association – while some landlords forbid them, communities that give residents a voice may be the best choice.

- Ask the hard questions – what have the rent increases been for the past 5 years? What are they likely to be for the next 10 years? What community maintenance fees are involved?

- Get all amenities, terms, and costs in writing – do not limit your investigation to the community’s brochure.

Personal Development Goals

Personal Development Goals

Bedrooms Designed for Aging in Place

Bedrooms Designed for Aging in Place Furniture

Furniture Kitchens Designed for Aging in Place

Kitchens Designed for Aging in Place Lighting and Light Switches

Lighting and Light Switches

Assisting With Functional Mobility

Assisting With Functional Mobility Bath and Shower Mobility Aids

Bath and Shower Mobility Aids Bedroom Mobility Aids

Bedroom Mobility Aids Assisting with Personal Grooming and Hygiene

Assisting with Personal Grooming and Hygiene Caring for Someone With Incontinence

Caring for Someone With Incontinence Helping People To Cope with Alzheimer’s and Dementia

Helping People To Cope with Alzheimer’s and Dementia Helping With Bill Paying

Helping With Bill Paying Home Cleaning Services

Home Cleaning Services Offering Companionship

Offering Companionship Providing Medication Reminders

Providing Medication Reminders Providing Transportation

Providing Transportation Running Errands

Running Errands

Burn Care

Burn Care Mental Health Rehabilitaion

Mental Health Rehabilitaion

Canes

Canes Chair Lifts / Stair Lifts

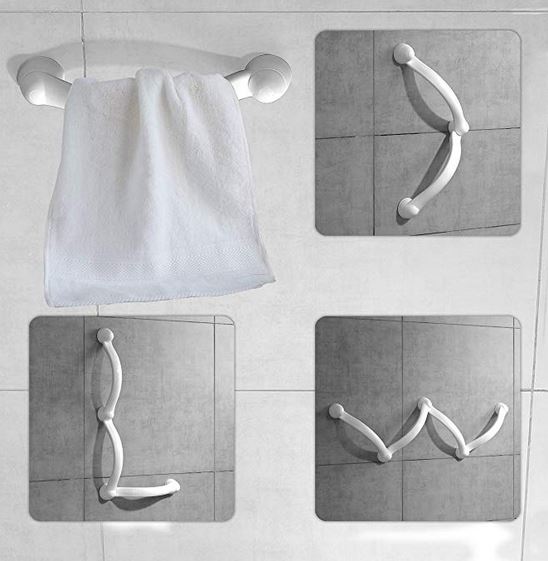

Chair Lifts / Stair Lifts Grab Bars

Grab Bars Knee Scooters / Knee Walkers

Knee Scooters / Knee Walkers Ramps

Ramps Scooters

Scooters Transfer belts / pads / equipment

Transfer belts / pads / equipment Walkers and Rollaters

Walkers and Rollaters Wheelchairs and Mobile Chairs

Wheelchairs and Mobile Chairs

Accounting and Tax

Accounting and Tax Books-Seminars-Courses

Books-Seminars-Courses

ASSISTED LIVING

ASSISTED LIVING Assisted Living Facilities

Assisted Living Facilities Cohousing Communities

Cohousing Communities Manufactured Housing Communities

Manufactured Housing Communities Naturally Occurring Retirement Communities (NORCs)

Naturally Occurring Retirement Communities (NORCs) Personal Residence LIving Independetly

Personal Residence LIving Independetly Accessory Dwelling Units

Accessory Dwelling Units Continuing Care Retirement Communities

Continuing Care Retirement Communities Multigenerational Households

Multigenerational Households