The majority of people approaching retirement age would like to age in place in their personal residence living independently. This could either be an existing residence or a new home. Whichever choice is made, the home will likely have to be modified somewhat to facilitate the aging in place process.

Below are some considerations when deciding whether to move to a new home, or to stay in your current home.

Reasons You May Want to Move to a New Location

- You live in an expensive area.

- You have more space than you need.

- You want to reduce your property taxes, insurance and maintenance costs.

- You want to live closer to friends or family.

- Your current home may not easily accommodate aging.

- You may be interested in a new retirement lifestyle.

If you live in a high-cost area near your job, or in a high property tax school district that your kids have outgrown, relocating to an area with significantly lower housing costs could serve to improve your retirement savings and may allow you to retire sooner.

For example, if you sell your current home for $350,000, purchase a new house for $175,000, and pay $30,000 for relocation costs, you could add $145,000 ($350,000 – $175,000 – $30,000) to your retirement savings.

Retirees often no longer need a large home once their children have grown up and moved out. Moving to a smaller home could help to reduce costs, provide a simpler-to-navigate floor plan, and be easier to clean and maintain.

Smaller homes often mean lower ongoing bills for property taxes, insurance, heating, cooling and maintenance. Utility rates and the general cost of living vary by location as well. You could save both on the number of rooms you have to light and heat, as well as on the rate you pay per unit of energy.

Moving closer to your children or grandchildren can enrich your retirement years. You can find a home reasonably close to them so that they are nearby when you need them, but on a day-to-day basis you can be as independent as possible.

You need to balance moving closer to them with perhaps moving away from your current familiar network. You may have very convenient shopping and access to your doctor; moving to be closer to family and friends may require you to establish new relationships and sources of services.

Some homes can be modified to make them safer and more comfortable for aging residents, but in other cases moving to a home set up or more easily modified for aging in place becomes necessary. You may also want to become a renter rather than an owner so that someone else has the responsibility of home maintenance. At some point you may give up driving, so you want to have transportation options available at the new home.

You may be tired of the snow in winter, or want to play a lot of golf, or fish, or stroll in the woods, or be by the water. You will need to balance these desires with the other factors discussed. If you are not certain of which way you lean, try renting in various places until you find something with the right balance.

Reasons to Stay

There may be many drawbacks of moving away from your friends, family and support system. The vast majority of people do not relocate in retirement, and those who do tend to move only very short distances. Here are some reasons why you may be better off not moving to a new place in retirement.

- You can save the costs of relocating.

- You have familiar service providers and know your way around.

- You have an existing social network.

- You live close to your family.

- You have many good memories where you are.

- You may be better able to prepare in advance for your later years.

- You like your current home and community.

Moving can be very expensive. Selling a home and buying a new one involves transaction costs in addition to the move itself. The money that you save by not moving might be enough to pay off any remaining mortgage loan balance you have, or will leave more in your savings.

If homes in areas to which you are contemplating moving cost nearly as much or more than your current home, you will not gain housing cost benefits to offset the moving costs. If not moving allows you to eliminate your mortgage loan before retirement, living mortgage-free can allow you to do more thing on your life list and significantly improve your retirement savings.

If you have been living in the same community for many years, you know your community and probably have many service providers with whom you are comfortable. You have a doctor you know, an auto mechanic you trust, a stylist or barber who cuts your hair just the way you like it, and a favorite server at a local restaurant.

You may also know how to avoid traffic at rush hour, the best way to the airport, and how to get to the veterinarian. If you move to a new location, you will have to invest the time to find new providers for each of these services and perhaps test out many options to find one that meets your preferences.

Loneliness is a common issue as people age. You may no longer be working outside the home where you see and interact with co-workers every day. Having a lot of friends nearby can enrich your retirement years socially. You may have had the same next-door neighbor for 30 years.

You may have an established sense of community and social support. Your social network also helps you solve problems by offering advice about whom they hired to fix the plumbing or help trim trees. If you plan to work in retirement, previous work contacts might be able to help you find a retirement job. Aging can be much more difficult if you do not have a support group of people.

If you currently live near your siblings, children and grandchildren, you may greatly enjoy spending time with them and watching your grandchildren grow up. Likewise, they might enjoy having you there and depend on you for babysitting, advice, and company. Adult children and older grandchildren may help you, too, when you need it.

You may save money if they can help you with small chores, including changing a furnace filter or giving you a ride to and from the doctor. Being surrounded by people who care about you can help you to live a longer, healthier life with fewer illnesses and fewer hospitalizations.

The home and community in which you raised your children likely holds many good memories. This may be the place your kids played sports or had their piano recitals, took their first steps, went to prom, or where you shared many other special moments which can be difficult to leave behind. You may not have good memories and are cherishing a fresh start, but odds are you do have many memories you would be sad to leave behind.

At some point, you may need to bring additional services into your home or make changes to the layout to prepare for the limitations of aging. If you anticipate that physical or cognitive needs will increase significantly in the next few years, you may want to ensure next-level services are available, or at least close by.

You may find it easier to locate and test these types of services where you currently live and can talk with your established support network, rather than in a new locale. You may also be able to better envision what you will need to do and can do to retrofit your current home to make aging easier in advance of when you need those features.

Regardless of how you ended up in your current home and community, you probably have grown to like them in many ways. You may have made improvements to your home that suit your needs and tastes, and perhaps participated in local community groups or organizations, which increased your attachment to the area. If your current community meets your needs as a retiree, you may decide that there is no reason to leave.

Personal Development Goals

Personal Development Goals

Bedrooms Designed for Aging in Place

Bedrooms Designed for Aging in Place Furniture

Furniture Kitchens Designed for Aging in Place

Kitchens Designed for Aging in Place Lighting and Light Switches

Lighting and Light Switches

Assisting With Functional Mobility

Assisting With Functional Mobility Bath and Shower Mobility Aids

Bath and Shower Mobility Aids Bedroom Mobility Aids

Bedroom Mobility Aids Assisting with Personal Grooming and Hygiene

Assisting with Personal Grooming and Hygiene Caring for Someone With Incontinence

Caring for Someone With Incontinence Helping People To Cope with Alzheimer’s and Dementia

Helping People To Cope with Alzheimer’s and Dementia Helping With Bill Paying

Helping With Bill Paying Home Cleaning Services

Home Cleaning Services Offering Companionship

Offering Companionship Providing Medication Reminders

Providing Medication Reminders Providing Transportation

Providing Transportation Running Errands

Running Errands

Burn Care

Burn Care Mental Health Rehabilitaion

Mental Health Rehabilitaion

Canes

Canes Chair Lifts / Stair Lifts

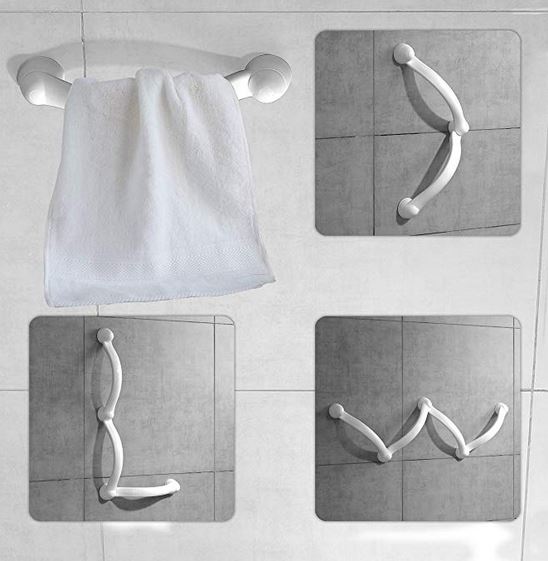

Chair Lifts / Stair Lifts Grab Bars

Grab Bars Knee Scooters / Knee Walkers

Knee Scooters / Knee Walkers Ramps

Ramps Scooters

Scooters Transfer belts / pads / equipment

Transfer belts / pads / equipment Walkers and Rollaters

Walkers and Rollaters Wheelchairs and Mobile Chairs

Wheelchairs and Mobile Chairs

Accounting and Tax

Accounting and Tax Books-Seminars-Courses

Books-Seminars-Courses

ASSISTED LIVING

ASSISTED LIVING Assisted Living Facilities

Assisted Living Facilities Cohousing Communities

Cohousing Communities Manufactured Housing Communities

Manufactured Housing Communities Naturally Occurring Retirement Communities (NORCs)

Naturally Occurring Retirement Communities (NORCs) Personal Residence LIving Independetly

Personal Residence LIving Independetly Accessory Dwelling Units

Accessory Dwelling Units Continuing Care Retirement Communities

Continuing Care Retirement Communities Multigenerational Households

Multigenerational Households