Finding Home Over 50: Achieving Your Housing Needs and Life List Dreams in Retirement Paperback – July 10, 2018

$29.99

Finding Home Over 50: Achieving Your Housing Needs and Life List Dreams in Retirement is a retirement planning book that helps you to maximize your comfort and enjoyment in your senior years. Much more than just a real estate book, Finding Home Over 50 helps you to assess and improve your financial foundation, identify and accomplish your life list goals, declutter your life, evaluate home care and home healthcare resources and options, and much more. Below is a summary table of contents from the book.

Introduction

PART 1 – Assessing Your Situation, Capabilities, and Life List Goals, and Preparing for Change

Chapter 1: Changes in Life, Changes in Living Needs

Chapter 2: Beginning to Formulate Your “Finding Home – Over 50” Plan

Chapter 3: Securing Your Financial Foundation

Appendix 3.1: Create Your Retirement Plan

Appendix 3.2: Government Retirement Plans and Medicare

Chapter 4: Decluttering Your Life

Chapter 5: Functional Assessment – Weighing and Addressing Your Needs and Those of Your Older Loved Ones

PART 2 – Housing Choices, and Finding the Right Home for You

Chapter 6: Housing Alternatives – Independent Living

Appendix 6.1: Selecting a Home Care Provider and / or a Home Healthcare Provider

Chapter 7: Housing Alternatives: Semi-Independent Living, Assisted Living, and Nursing Care Options

Appendix 7.1: Evaluating Senior Living Communities

Appendix 7.2: Adult Day Care Facility Evaluation Checklist

Chapter 8: Should I Stay or Should I Go? – Choosing Your Home Location

Chapter 9: Preparing Your Current or New Home for Aging in Place

PART 3 – Reverse Mortgages, and Organizing your Estate Documents

Chapter 10: Mortgage Loans in Reverse

Chapter 11: Organizing Your Estate Documents

Glossary

Index

You and about 70 million other persons aged 50 to 70 in the U.S. are in the early stages of planning for and entering into retirement. It is a journey of sorts, during which you will be identifying your retirement housing needs and options, figuring out where you would like to live, and determining the associated costs. Your family, friends, support system, desires, and fears will factor into your thought processes. Part of what you need to consider and plan for is making sure you have adequate time, money, and other resources available to you after paying for housing to pursue the list of life goals you would like to accomplish while you are still young enough to do so. Your housing choices and life list goals can be aligned to allow you the time and money to enjoy your life, and to maximize what you can achieve. Find Home Over 50 is your guidebook for that journey.

Many people over 50 are also contending with housing and related issues involving aged parents, in-laws, or older loved ones, as well as perhaps Millennial (or younger) children who may still be living in their homes. You may be one of those people, part of the so-called “sandwich generation,” dealing with issues and needs of older and younger loved ones. Finding Home Over 50 also speaks to those issues.

In a few short hours, rather than days and weeks, you can gain a good understanding of the housing issues you are most likely to be encountering over the coming years, and some guidance on choices, options, pitfalls, economics, and other elements key to your decision-making making process. The conversational manner in which the information is presented will make it more meaningful and easier to understand.

Michael W. Trickey is a CPA with over thirty-seven years of experience working with real estate finance transactions. He is an active participant in the residential and commercial real estate markets, both as a consultant to others and for his own use and investment. Over the last thirty-seven years, he has been involved in dozens of real estate transactions, purchasing condos, single-family homes, duplexes, multi-unit flats, apartment buildings, and commercial buildings.

This is the second book in the Finding Home series. The first is geared towards first-time home buyers.

Related products

50 States, 5,000 Ideas: Where to Go, When to Go, What to See, What to Do Paperback – February 7, 2017

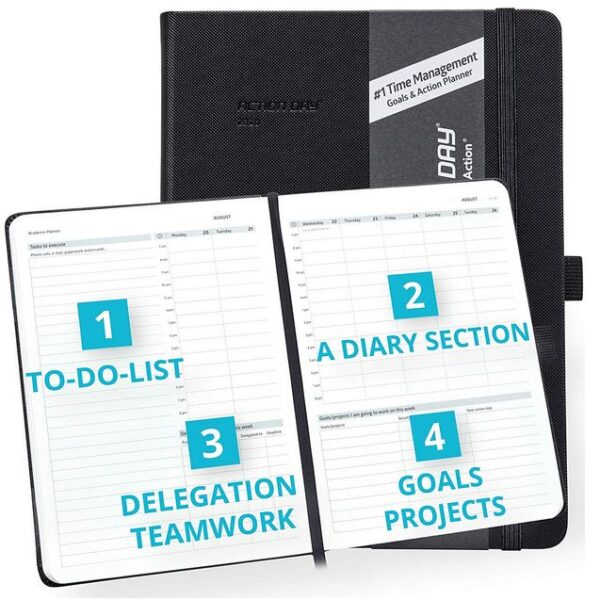

Action Day Planner 2020 – #1 Time Management Design That Makes It Easy for You to Get Things Done, Daily Weekly Monthly Yearly Journal, Agenda, Hardcover, Pocket, Pen Loop, Thick Paper (6×8, Black)

- Planner 2020 - DATED: January 2020 through December 2020. The weekly time management layout allows you to plan seven days, from Monday to Sunday, all in one 2-day page spread; (to-do-list, diary section for appointments, delegation & teamwork section, goals and projects section). Each day offers hourly scheduling from 7:00 AM to 8:00 PM. You also have; month at-a-glance pages for the year and academic (mid-year) almanac and next year calendar + 24 pages for note-taking

- Design That Makes It Easy for You to Get Things Done: The planner makes it easier for you to accomplish results, because the layout is a unique time management design, designed to set goals, create to-do list, delegate, plan teamwork, project planning and get things done!

- Best-Sellers in the US, Canada and the UK: The planner has been used by hundred and thousands of people since 2003 in the US, Canada and Europe. Action Day planner has been used by; entrepreneurs, business people, leaders, managers / CEO / COO / CFO / CTO, project managers, salespeople, service people, military, busy parents (mom/dad), teachers, students

- Enhance Your Life: The planner brings new clarity to the power of your purpose, because it contains 12-page teaching tool to see yourself as the person you want to be, what values you want to live by, your goals and actions. The planner helps you to keep focus and live a more fulfilling live

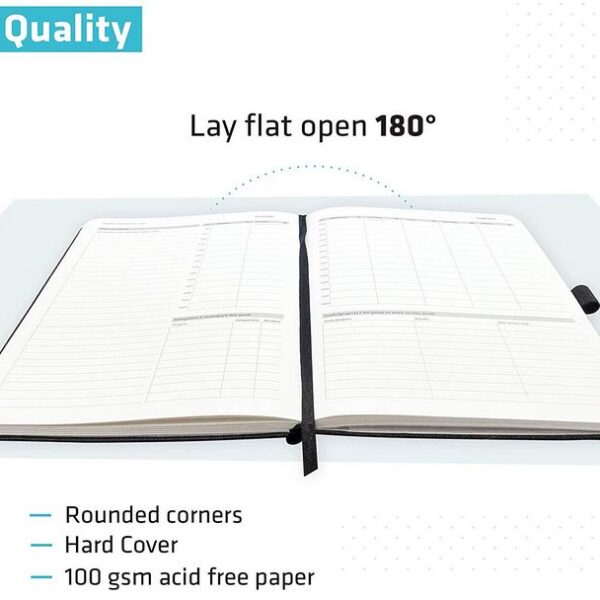

- VALUE ADDED FEATURES & QUALITY: Bookmark, elastic closure, elastic pen loop, inner pocket, note-taking pages. Pages made from 100 gsm acid-free, FSC certified paper—resists damage from light and air. Hardcover, rounded corners, lay flat open 180°

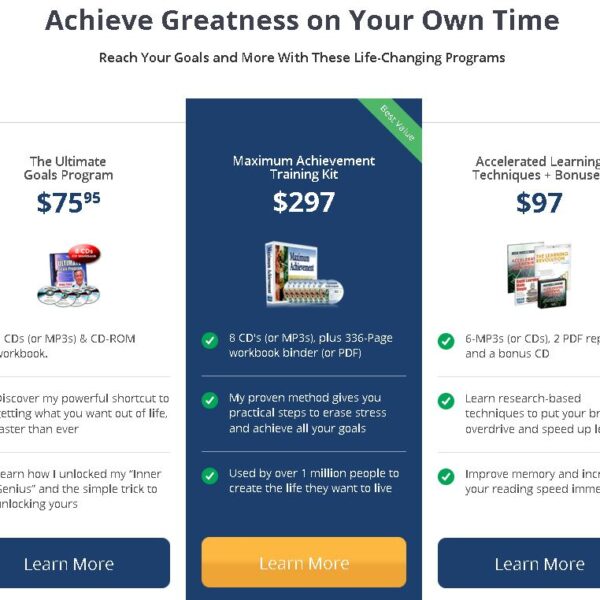

Brian Tracy Personal Development Programs

- Success is a Journey - DVD Plus Bonus $ 44.95

- Maximum Productivity with Brian Tracey $597.00

- Personal Success Made Simple $197.00

- Goals! $ 22.95

- The Miracle of Self Discipline $197.00

- Doubling Your Productivity $ 60.00

- The Science of Self-Confidence Training Kit $197.00

- The Power of Clarity Plus Bonuses $247.00

- Eat That Frog! 3rd Edition $ 14.95

- The Ultimate Goals Program $ 75.00

- Maximum Achievement Training Ki t $297.00

- Accelerated Learning Techniques + Bonuses $ 97.00

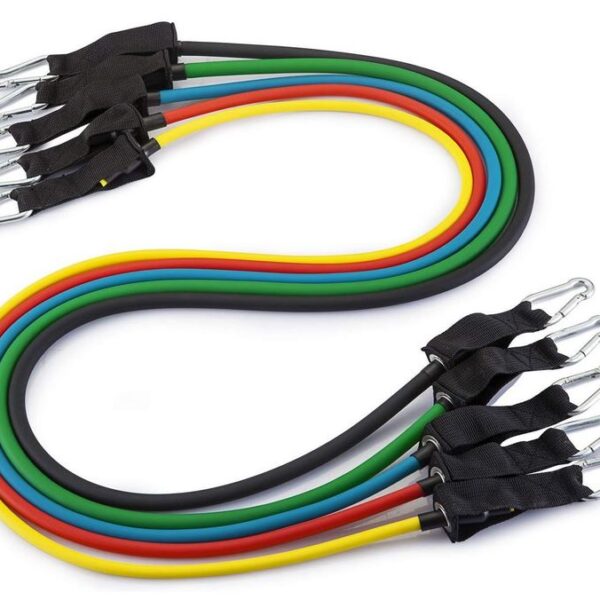

Fit Simplify Resistance Band Set 12 Pieces with Exercise Tube Bands, Door Anchor, Ankle Straps, Carry Bag and Instruction Booklet – Bonus Ebook and Online Workout Videos

- Your own personal home gym. This premium resistance band set includes a door anchor and two ankle straps to allow you to perform the widest variety of resistance training exercises possible. Perform full body workouts, strengthen your core, and isolate specific muscle groups. Great for toning your quads, glutes, buttocks, abs, biceps, triceps, legs and knees. Works well with various exercise programs.

- Used by fitness professionals. Trainers use our bands to create effective fitness & weight loss programs for their clients. Perform low-impact exercises that can help you during physical therapy and recover and rehab from injury. Perfect for both men and women of all fitness levels and ages - beginner, intermediate or workout pros. Comes with Instructional Booklet and complimentary access to eBook and our online videos

- Stackable bands for adjustable resistance levels. Comes as a set of 5, 48-inch long colored exercise bands. Yellow, Red, Green, Black, and Blue bands can also be combined together to provide up to 120 lbs of resistance. Metal clip system allows you to attach the included soft-grip handles or ankle straps for a more comfortable workout.

- Highest quality materials. Made from 100% eco-friendly natural latex which is extremely durable, and bands will maintain their resistance for a long time. Each tube band is carefully constructed to resist snapping and breaking. Comes with convenient travel pouch so you can take your bands to gym, office, and even workout on vacation.

- Lifetime guarantee. The resistance bands with color-coded resistance levels and accessories come with a manufacturer’s Lifetime Warranty.

Invite Health Elderly Men’s Sexual Health Program

ProsourceFit Puzzle Exercise Mat, EVA Foam Interlocking Tiles, Protective Flooring for Gym Equipment and Cushion for Workouts

- PROTECTIVE WORKOUT FLOORING - Durable, non-skid textured tiles protect floors while creating a comfortable workout space

- EASY ASSEMBLY – Lightweight puzzle pieces connect quickly and easily, and can be disassembled just as simply for quick storage

- VERSATILE – The water-resistant and noise-reducing design is easy-to-clean, great for use in garages, gyms, home fitness rooms, or even children’s play areas

- COVERS 24 SQ. FT. - Each tile measures 24” x 24” x ½”- thick from the highest point of the texture; Includes 6 tiles and 12 end borders for a polished look

- HIGH QUALITY FOAM - High-density EVA foam provides excellent support and cushion; Contains NO toxic phthalates

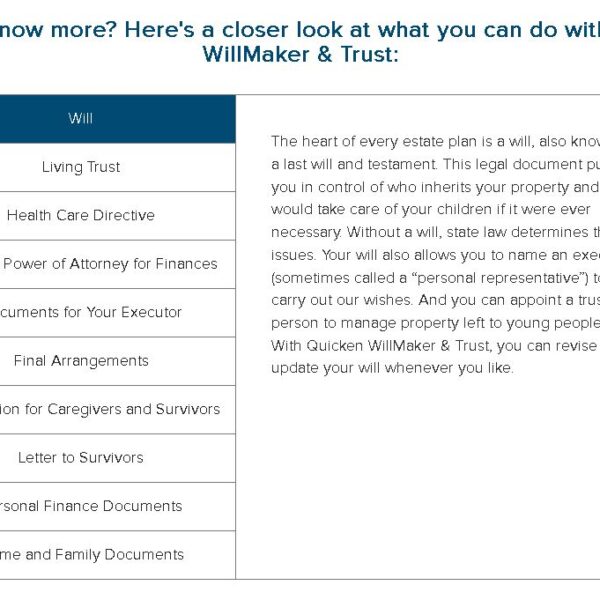

Quicken WillMaker and Trust 2020

Quicken WillMaker & Trust 2020 Includes:

ESTATE PLANNING DOCUMENTS

- Legal Will

- Revocable Living Trust

- Durable Power of Attorney for Finances

- Final Arrangements

- Health Care Directive (Living Will & Health Care Power of Attorney)

- Information for Caregivers and Survivors

- Letter to Survivors

- Property Worksheet

- Revocation of Health Care Directive

HOME & FAMILY DOCUMENTS

- Authorization for International Travel With Minor

- Authorization for Minor's Medical Treatment

- Authorization to Drive a Motor Vehicle

- Child Care Agreement

- Child Care Instructions

- Elder Care Agreement

- Pet Care Agreement

- Housekeeping Services Agreement

- Housesitting Instructions

- Request for Birth Certificate

- Notice to Put Name on Do Not Call List

- Subscription or Membership Cancellation form

- Temporary Guardianship

- Authorization for Care of Minor

EXECUTOR DOCUMENTS

- Affidavit of Domicile

- Employee Death Benefits Letter

- Executor's Letter to Financial Institution

- General Notice of Death

- Request for Death Certificate

- Notice to Creditor of Death

- Executor's Checklist

PERSONAL FINANCE DOCUMENTS

- General Bill of Sale

- Security Agreement for Borrowing Money

- Limited Power of Attorney for Finances

Personal Development Goals

Personal Development Goals

Bedrooms Designed for Aging in Place

Bedrooms Designed for Aging in Place Furniture

Furniture Kitchens Designed for Aging in Place

Kitchens Designed for Aging in Place Lighting and Light Switches

Lighting and Light Switches

Assisting With Functional Mobility

Assisting With Functional Mobility Bath and Shower Mobility Aids

Bath and Shower Mobility Aids Bedroom Mobility Aids

Bedroom Mobility Aids Assisting with Personal Grooming and Hygiene

Assisting with Personal Grooming and Hygiene Caring for Someone With Incontinence

Caring for Someone With Incontinence Helping People To Cope with Alzheimer’s and Dementia

Helping People To Cope with Alzheimer’s and Dementia Helping With Bill Paying

Helping With Bill Paying Home Cleaning Services

Home Cleaning Services Offering Companionship

Offering Companionship Providing Medication Reminders

Providing Medication Reminders Providing Transportation

Providing Transportation Running Errands

Running Errands

Burn Care

Burn Care Mental Health Rehabilitaion

Mental Health Rehabilitaion

Canes

Canes Chair Lifts / Stair Lifts

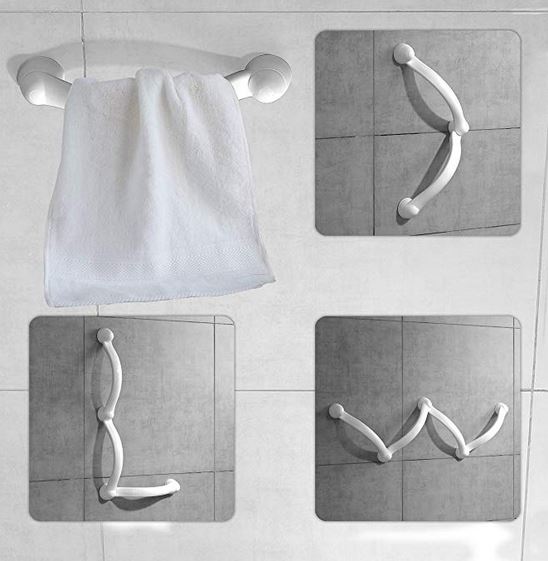

Chair Lifts / Stair Lifts Grab Bars

Grab Bars Knee Scooters / Knee Walkers

Knee Scooters / Knee Walkers Ramps

Ramps Scooters

Scooters Transfer belts / pads / equipment

Transfer belts / pads / equipment Walkers and Rollaters

Walkers and Rollaters Wheelchairs and Mobile Chairs

Wheelchairs and Mobile Chairs

Accounting and Tax

Accounting and Tax Books-Seminars-Courses

Books-Seminars-Courses

ASSISTED LIVING

ASSISTED LIVING Assisted Living Facilities

Assisted Living Facilities Cohousing Communities

Cohousing Communities Manufactured Housing Communities

Manufactured Housing Communities Naturally Occurring Retirement Communities (NORCs)

Naturally Occurring Retirement Communities (NORCs) Personal Residence LIving Independetly

Personal Residence LIving Independetly Accessory Dwelling Units

Accessory Dwelling Units Continuing Care Retirement Communities

Continuing Care Retirement Communities Multigenerational Households

Multigenerational Households