Reverse Mortgages – A Primer

A so-called “reverse mortgage” is a special type of home loan that allows borrowers to convert a portion of the equity in their home into cash and then not have to make ongoing monthly payments on the loan. Reverse mortgages are generally available only to borrowers who are at least 62 years old. People use money borrowed under reverse mortgages to supplement retirement income, pay off an existing “forward” mortgage, meet medical expenses, make home improvements, and for a myriad of other purposes.

Reverse mortgages are widely misunderstood, but if you have cash needs, one might make sense for you. You should evaluate the suitability of a reverse mortgage for you based on a number of factors which are subjective and specific to your circumstances and needs.

EagleHealth Toilet-to-Tub Sliding Bench 77993 XXL

- Toilet-to-Tub Sliding Transfer Bench (77993) makes transferring from toilet to tub easier, safer

- CutOut for personal cleaning. Seat slides, locks at each end. Tool-free assembly. Height adjustable

- Base Length: 64.5"-65.5" (XXL). Specs below. Assemble to face either right or left. Armrests #71002

- Middle legs installed anywhere along rails. Other lengths: EagleHealth #77963 (Long) & #77983 (XL)

- This Hygiene Product is NON-RETURNABLE once opened. Please measure your tub and bathroom carefully.

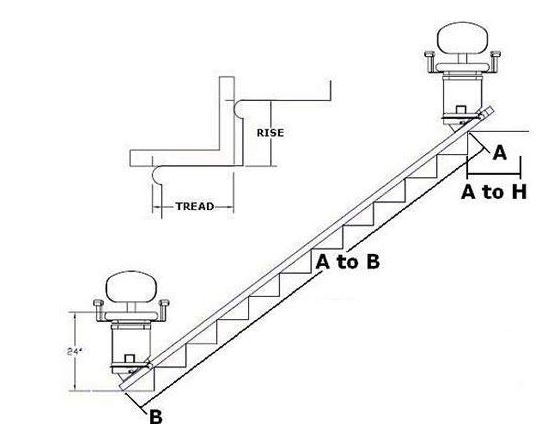

Harmar Outdoor Stair lift 350-OD

- Header cover, internal chassis cover and a large weatherproof cover included

- Rocker controls with constant-pressure functionality stop the lift immediately if the control is released

- Mounts to the stairs (not the wall) on either side of staircase Operates on standard 115 VAC household current

- Extruded aluminum track is available in custom lengths. Seat and footrest fold to save space

- Upholstery Colors: Light Almond, Evergreen, Mocha - **This product will be custom cut to fit your staircase. Because this is a "Custom Made" product - it is NOT returnable. **Please provide the following Information - length of staircase (see images), mounted on the left or right as you look UP the steps, any obstructions at top or bottom, landing, hallway or door at the top of the steps?

How Reverse Mortgages Work

In a traditional mortgage loan, the lender advances a large sum of money upfront that the borrower uses to buy a home or refinance an existing home loan. The borrower then pays the mortgage loan down over time with monthly payments. The traditional (“forward”) mortgage loan balance starts out large and is paid down over time.

In a reverse mortgage, the borrower already owns the home, and owes very little or nothing on it. Under the terms of the reverse mortgage, the borrower will receive some combination of upfront and/or ongoing monthly (or periodic) payments from the lender. The reverse mortgage loan balance starts low and grows larger over time.

Depending on the design of the reverse mortgage, the lender may pay you a (smaller) lump sum amount upfront, and then continue to pay you monthly amounts thereafter. The size of your upfront and monthly payments will depend on the value of your home, the age of the youngest co-borrower, the rate at which interest accrues on the loan, any mortgage insurance premiums that accrue[1], an assessment of your ability to pay ongoing taxes and insurance, and other features of the reverse mortgage product you choose.

The money you get upfront and/or monthly is usually tax-free and generally will not affect your Social Security or Medicare benefits. When the last surviving borrower (or non-borrower spouse) dies, sells the home, or has no longer lived in the home as a principal residence for more than 12 months, the reverse mortgage loan has to be repaid. Sometimes that means selling the home to get money to repay the loan. In certain loan programs, a non-borrowing spouse may be able to remain in the home, as long as they went to counseling and have agreed to the loan terms.

Reverse mortgage lenders generally charge an upfront origination fee and other closing costs, and some charge servicing fees over the life of the mortgage. For FHA insured reverse mortgage loans, they also collect both upfront and ongoing mortgage insurance premiums.

The rate used to accrue interest on reverse mortgages generally can be fixed or variable, but is usually variable.[2] This means the rate is tied to a designated financial index and will change as the market level of that financial index goes up and down. Interest and MIP on your reverse mortgage is not deductible on your income tax returns until the year it is paid – usually when you pay off all or a portion of the loan.

[1] Jumbo reverses mortgages (those with balance limits in excess of the FHA lending limit of $636,150) do not have mortgage insurance premiums.

[2]Jumbo reverse mortgages are fixed rate.

Variable Rate Loans

Variable rate loans generally provide more options on the timing and magnitude of amounts paid to you through the reverse mortgage. Fixed rate reverse mortgages are less flexible, tending to require you to take your loan as a lump sum at closing. The total amount you can borrow with a fixed rate loan is generally less than the amount you could get with a variable rate reverse mortgage loan.

You Keep Your Title

As with other types of mortgage loans, you keep the title to your home. You are still responsible for paying property taxes, insurance, utilities, fuel, maintenance, homeowner’s association (HOA) fees, and other expenses. If you fail to pay your property taxes or homeowner’s insurance premium in a timely manner, or fail to maintain your home, the lender may declare you in default on your loan and require you to repay it in full or they will foreclose.

Life Expectancy Set Aside Amount

Your lender will assess your financial condition when you apply for the mortgage. Based on this assessment, the lender may require a “Life Expectancy Set-Aside” amount to pay your property taxes, homeowner’s insurance premiums, HOA fees, and flood insurance premiums (if any) during the term of the loan. The lender will hold the set-aside amounts in escrow and use them to pay your taxes and insurance as they come due. The set-aside amount reduces the funds you receive upfront and/or in your monthly payments. You are still responsible for maintaining your home.

EagleHealth Toilet-to-Tub Sliding Bench 77993 XXL

- Toilet-to-Tub Sliding Transfer Bench (77993) makes transferring from toilet to tub easier, safer

- CutOut for personal cleaning. Seat slides, locks at each end. Tool-free assembly. Height adjustable

- Base Length: 64.5"-65.5" (XXL). Specs below. Assemble to face either right or left. Armrests #71002

- Middle legs installed anywhere along rails. Other lengths: EagleHealth #77963 (Long) & #77983 (XL)

- This Hygiene Product is NON-RETURNABLE once opened. Please measure your tub and bathroom carefully.

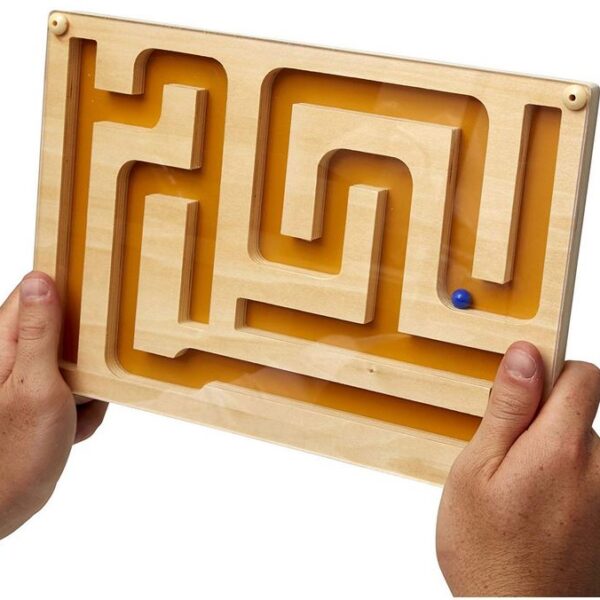

399 Games, Puzzles & Trivia Challenges Specially Designed to Keep Your Brain Young.

Tearaway Jeans Premium Breakaway Pants – Elastic Waist Faux Denim Pants

- LOOK LIKE REAL JEANS: Function and Style Come Together Wonderfully!! The Look of Real Jeans Gives the Wearer Style and Confidence While the Elastic Waist and Side Button Closure Provide Easy Access and Comfort!!

- MEDICAL CONVENIENCE: Extremely Convenient For Post Surgery, Physical Therapy or Rehab, Dealing With Leg Casts, Doctor Visits, Sports Injuries, Injured Knee/ACL, Ankle, Foot, Hip, Leg, the Elderly, Handicapped And Anyone With Limited Mobility.

- TRUE HIGH QUALITY PANTS: They Are Made Of Super Soft Durable Light Weight Material For Ultimate Comfort! Perfect For Lounging! They Also Feature Durable Metal Buttons, Elastic Waist and 3 Zippered Pockets!

- DEEP POCKETS: These Break Away Pants Were Made With 2 Deep Side Pockets and 2 Deep Back Pockets To Prevent Loss Of Your Belongings and Increased Storage Space!

- PARTY TIME: Need An Undercover Stripping Outfit?? These Rip Off Trousers Are For You!! When The Music Hits, You Will Have The Option To Take The Party To The Next Level!!

Finding Home Over 50: Achieving Your Housing Needs and Life List Dreams in Retirement Paperback – July 10, 2018

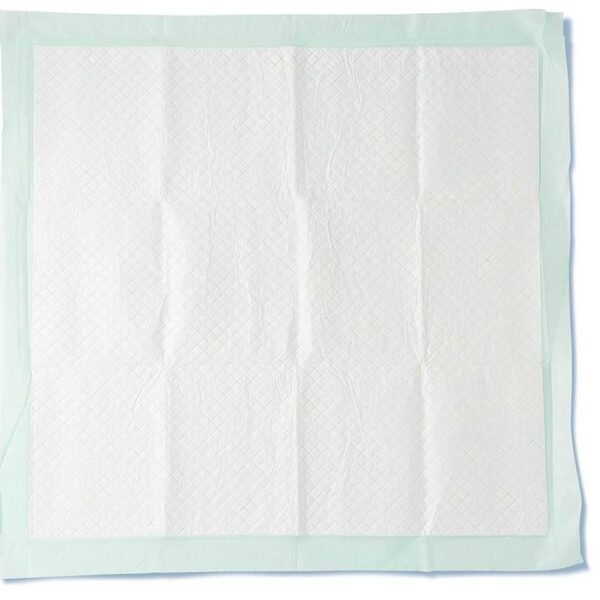

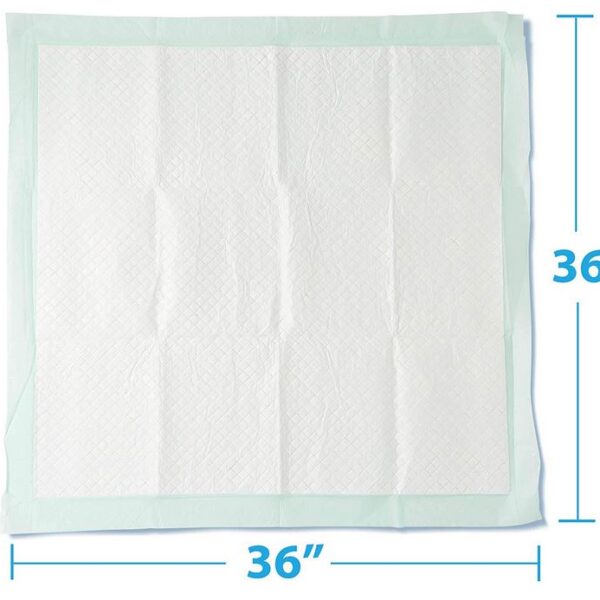

Medline Heavy Absorbency Underpads, 36″ x 36″ Quilted Fluff and Polymer Disposable Underpad, 50 Per Case, Great Protection as Bed Pads and Pee Pads

- HEAVY ABSORBENCY - Medline's 36 x 36 inch disposable underpads feature a super absorbent core to provide incontinence protection for beds, furniture and floors

- SOFT QUILTED TOP SHEET - Disposable bed pads with a soft diamond quilted top sheet is gentle on sensitive skin

- CORE ABSORBS FLUID AND LOCKS AWAY ODOR - The fluff and polymer chux pad core absorbs fluid and quickly locks away odor

- LARGE 36 x 36 INCH SIZE - The large size of this underpad makes it great for use as bed pads, furniture protectors or puppy pee pads

- CONVENIENTLY PACKAGED 50 PER CASE - These chux are pre-folded and can easily fit in a bag for on the go convenience

Pevor Urinary Drainage Bag Urine Collection Bag with Anti-Reflux Chamber Medical Drain Bag 48″ Drainage Tub, 2000ml (Pack of 5)

- Urinary Drainage Bag -2000 mL Urinary Drainage Bag, Vented Anti-Reflux Chamber, 48 Inch Drainage Tube. Durable construction for odor containment and leak resistance

- Clothing Clamp and Anti-reflux Chamber -Clothing Clamp, you can conveniently attach to patient’s clothing or on the sheet and make sure that the tube doesn’t get twisted or dragged on the floor. Additionally, there is an anti-reflux chamber to reduce gross reflux and backflow

- Multipurpose Bag - Ideal for non-ambulatory individuals, hospitalized patients and those who require incontinence care while sleeping, this bag features a 2000-ml volume so you can leave unattended for hours before it needs to be drained. Equipped with hooks for easy suspension. The handle/hanger fits securely onto a bedrail or wheelchair for added convenience

- Pack of 5 - Convenient independent packaging design can reduce pollution. Total 5 Pcs per package. We suggest each bag is a one-time use only for sanitation purposes and should be discarded when through.

- Warm Tip - The drainage bag, when used daily, should last not more than one month. Discard and replace bags earlier if they become discolored, brittle or if they smell even after cleaning.

What Happens If You Die?

If you signed as a borrower on the loan and your spouse did not[3], the rights of your spouse to stay in the home are dependent on the category of the loans and the lender’s terms. With FHA insured reverse mortgages (called HECM[4] loans), your spouse may continue to live in the home even after you die if he or she pays the property taxes, insurance, and HOA fees, and continues to maintain the property. But your spouse will stop getting money from the undrawn portion of the HECM loan since he or she wasn’t part of the loan agreement. With loans not insured by the FHA (proprietary loans), when you die, your spouse or estate may be required to pay off the loan, which may require selling the property. You need to clearly understand the offered terms before you take out the loan

[3] Even though your spouse is not an obligor on the loan, he or she will still have paperwork to sign in order for you to be able to get the loan.

[4] HECM is an acronym for Home Equity Conversion Mortgage . . . HECMs are federally-insured reverse mortgages that are backed by the U. S. Department of Housing and Urban Development (HUD).

You or your heirs do not have to be pay off the loan until the home is sold (unless a default occurs). The loan is repaid from the proceeds of the property sale. Any remaining equity in the home after the loan has been repaid belongs to you, your surviving spouse, or your heirs.

Depending on how long you live and the rates at which interest and mortgage insurance premiums accrue on your loan, the accumulating amount owed to the lender on a reverse mortgage loan can come close to, or even exceed, the value of your home. This means that little or no equity could be left for you, your surviving spouse, or your heirs. However, FHA insured reverse mortgages have in them what is known as a “non-recourse” clause. This means that you, or your estate, cannot owe more than the value of your home when the loan becomes due and the home is sold. FHA insurance is used to pay any difference.

Generally, with a HECM, if you or your heirs want to pay off the loan and keep the home rather than sell it, you or they would not have to pay more than the appraised value of the home, and in some cases no more than 95% of the appraised value

Reverse Mortgage Loan Options

Categories

When considering whether a reverse mortgage is right for you, be aware that there are three general categories with differing features, benefits and costs. Depending on your circumstances, one category may meet your needs better than the others.

Home Equity Conversion Mortgages (HECMs)

Most reverse mortgage loans are categorized as Home Equity Conversion Mortgages (HECMs). These loans are insured by the FHA, and borrowers are charged a mortgage insurance premium (MIP). They are limited in size to $636,150. Proceeds may be used for any purpose, except making certain investments. These loans have caps on origination fees, and borrowers are not charged monthly servicing fees. Borrowers and non-borrowing spouses must attend HECM counseling. Even though non-borrowing spouses are not obligated on the loan, they are required to sign documents indicating that they understand the terms of the loan. Non-borrowing spouses do retain rights of survivorship in the home after the borrowing spouse dies, meaning they can continue living in the home.

Proprietary Reverse Mortgages

Reverse mortgages in excess of HECM lending limits are called jumbo loans and are categorized as proprietary reverse mortgages offered by private lenders. There is no mortgage insurance on these loans, and borrowers are thus not charged MIPs. Loan proceeds may be used for any purpose. These loans have no caps on origination fees, and the lender may charge borrowers monthly fees for loan servicing. Borrowers and non-borrowing spouses may or may not need to attend pre-loan counseling, depending upon the lender’s program. Non-borrowing spouses are not obligated on the loan, and they may not be required to sign documents indicating that they understand the terms of the loan. Non-borrowing spouses may or may not retain rights of survivorship in the home after the borrowing spouse dies. You should carefully study each lender’s program terms.

Single Purpose Reverse Mortgages

Single purpose reverse mortgages are the least expensive option, and programs vary. They are offered by some state and local government agencies, as well as non-profit organizations. You may use proceeds from these loans only for program-designated purposes, such as to pay for home repairs, improvements, or property taxes. Homeowners with low or moderate incomes may qualify for these loans. Terms and requirements vary by program, and you should study them carefully.

Disbursement Options

Reverse mortgage lenders generally offer a choice of several disbursement options. For fixed interest rate reverse mortgages, your choice will likely be limited to a single lump sum disbursement plan whereby you will receive the amount at the close of the loan. A single disbursement option typically offers less money than other reverse mortgage disbursement plan options because of first year principal limitations[5] and the fact that you do not benefit from increases in the value of your home.

[5] This amount is called your “initial principal limit.” Your lender will calculate how much you can borrow, based on your age, the interest rate, the value of your home, and your financial assessment.

- ZERO IMPACT EXERCISE: Ideal for all fitness levels, the comfortable and naturally-reclined seated position reduces body fatigue and eliminates the stress on the joints and back while still delivering a full fat-burning cardio workout.

- WHISPER-QUIET, FLUID STRIDE: The unique striding motion protects your knees and joints while engaging near-silent variable magnetic resistance that adjusts with one simple dial.

- TOTAL BODY WORKOUT: Dual power motion works your upper and lower body simultaneously, engaging all major muscle groups to build strength and burn more calories. Modify the workout by isolating your legs or arms for added intensity.

- SMART DESIGN: Track progress with the easy-to-read, battery-powered digital console; device stand and water bottle holder; convenient transport wheels.

- COMMERCIAL-GRADE ENGINEERING: Friction-free linkage system means long-lasting use; 54" x 38" footprint is a low profile addition to your home.

33″ Long Dressing Stick with Shoe Horn with Sock Removal Tool, Adjustable Extended Dressing Aids for Shoes, Socks, Shirts and Pants

- Multi-function - Medical Supply Dressing Stick with Shoe Horn with Sock and shoe Remover Tool;Extended Reach Assist.Extendable dressing aid with shoe horn makes getting dressed easier from head to toe. Shoe horn on one end helps guide your heel into shoes, boots and slippers, saving you from bending and reaching. Opposite end features dressing hooks that help you pull on socks, shoes, pants and tops without straining.Easy-to-use sock assist tool makes dressing easier. Versatile design is ideal for

- Easily detaches for travel - Uniquely Design Separating into three short pieces;33inch Long enough; the detachable shoe horn easily fits in a handbag, carry on or tote for use while traveling and for compact storage.

- Durable Construction - Sturdy fiber-reinforced ABS plastic, the JJDPARTS detachable shoe horn is exceptionally durable and easy to clean. Each edge has a smooth rounded finish to prevent snags and tears in socks and to prevent scuffed shoes.

- Ideal For - Dressing sticks are often recommended by therapists and other health care professionals for users who have difficulty reaching, limited mobility. This simple tool can make life a little easier when it comes to dressing. The Dressing Stick helps users with arthritis to perform a variety of tasks.

- Lifetime Guarantee - Lifetime guarantee so you can purchase now with confidence

399 Games, Puzzles & Trivia Challenges Specially Designed to Keep Your Brain Young.

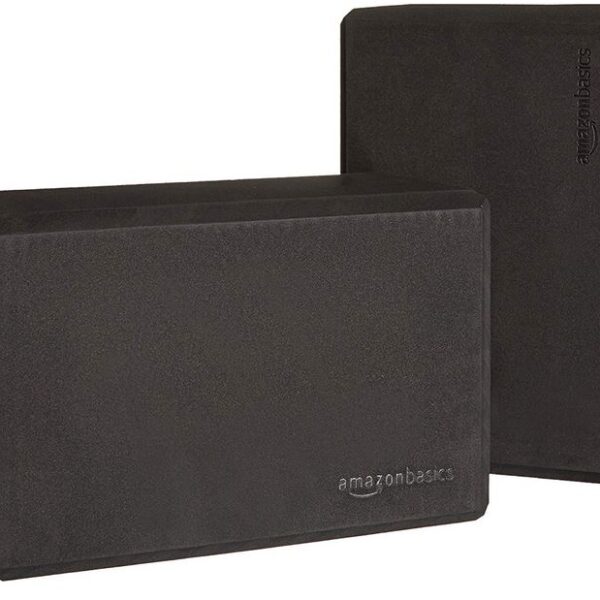

AmazonBasics Yoga Blocks, Set of 2

- Set of 2 yoga blocks help promote better balance, proper alignment, and deeper poses

- Made of durable, high-density foam for reliable support and long-lasting performance

- Slip-resistant surface help ensure a secure hold; round edges for a comfortable, steady grip

- Lightweight and modular; use separately or stacked together in a variety of configurations

- Large enough to comfortably sit on; measure 4 by 9 by 6 inches each (LxWxH)

BUNMO Adaptive Utensils for Elderly/Arthritis/Weak Hand Grip & Handicapped – Convenient Travel Pouch

- LARGE EASY-GRIP HANDLES: Our light weighted foam grip handles are designed for maximum hold

- SUPPORTIVE UTENSILS – Specially designed assistive devices. Great as elderly & handicap utensils

- CONVENIENT FOUR-PIECE SET: Tablespoon, teaspoon, rocker knife and fork. Perfect arthritis aids

- PREMIUM STAINLESS STEEL: BunMo Adaptive Silverware is made of high quality rustproof stainless steel

- SHARP KITCHEN KNIFE: Original curved design, sharp and meets the standards of adaptive equipment

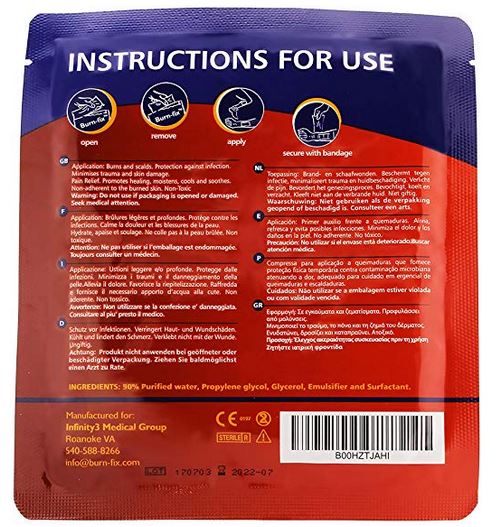

Burn-FIX- 4 Pack-Burn Gel Dressing 4″ X 4″ Burn Care-First Aid Treatment. Immediate Pain Relief Burn Cream- Hydrogel For 1st, 2nd Degree Burns, Chemical, Razor and Sunburns. For Home, Work, Fire, EMS.

- "TAKES THE BURN OUT OF BURNS"- STOPS THE PAIN! Burn-Fix proprietary formula burn gel dressing is indispensable. Immediately place the sterile burn dressing on the burned area and notice how quickly the burning stops. Very unique as it acts as a ""heat sink"" and pulls the heat of the burn. Burn- Fix is the best burn wound dressing available today and may save a trip to the emergency room.

- COOLS, MOISTURIZES & STARTS THE HEALING PROCESS. Potentially Decreases Healing Time. Non-adherent- Helps Protect Against Contamination. After placing the 4 X 4 burn relief dressing, you can wrap it with gauze or plastic wrap for additional protection. One of the best burn remedies you can find today.

- ALL NATURAL INGREDIENTS-To Feed Your Skin Back to Health. Our non-prescription, sterile dressing burn pads also just feel good on your skin unlike anything other burn treatment else you can use. Non-adherent- Helps Protect Against Contamination.

- CONVENIENT-4 PACK BURN BANDAGES - Must Have For Workers Around Fire, Kitchen and Recreation. Keep In Home, Car, Boat, RV and Camping First Aid Kits! Just add Burn-FIX burn dressings to your First Aid supplies to make a specialty burn kit.

- BURN-FIX UNCONDITIONAL GUARANTEE- Better Than Money Back - If you are not 100% THRILLED, Please let us know and will refund your purchase!

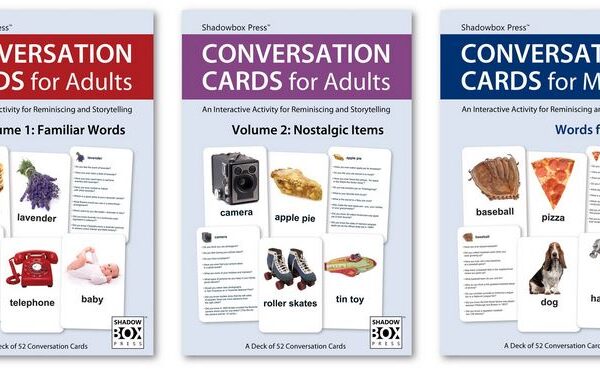

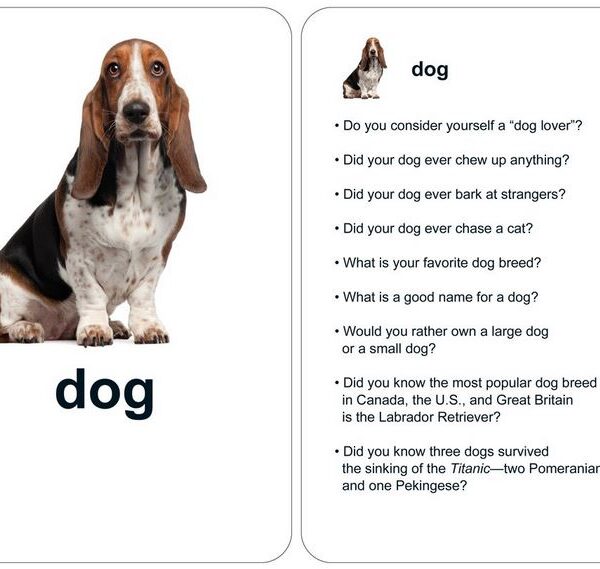

Conversation Cards – Three-Deck Set – Reminiscence Activity for Alzheimer’s / Dementia / Memory Loss Patients and Caregivers Cards

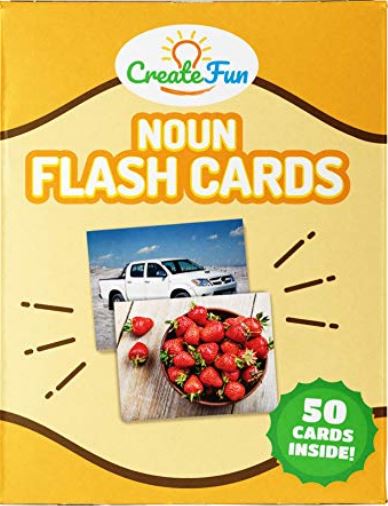

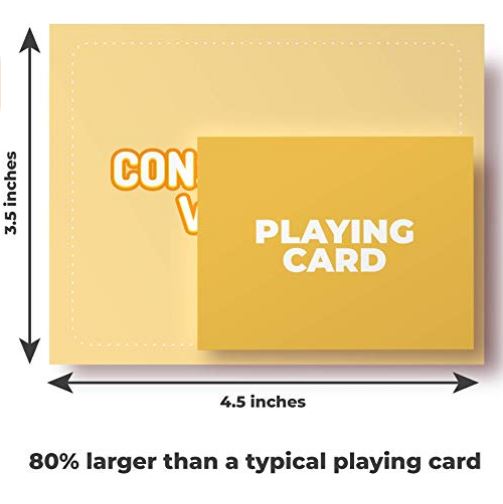

CreateFun Noun Flash Cards – 50 Educational Vocabulary Builder Picture Cards – 5 Learning Games – Toddlers, Preschool Teachers, Speech Therapy Materials and ESL Teaching Materials

- MASTER: Nouns and Categories. Ideal for Preschool Prep, Speech Therapy and ELL. Promote clear communication, conversation and development.

- MODERN FLASHCARDS, Diverse Images, HD Quality Photos, Child and Adult Friendly.

- IDEAL FOR Kids and Adults: Preschool Prep, Speech Therapy, ELL, Special Education PECS and ABA. With up to 25% more cards than other sets. 50 high quality flashcards 2 instructional cards! Whether you're a parent, teacher or therapist, use these pictures and words to promote clearer communication, critical thinking skills, conversation and reasoning for all ages.

- IMPROVE YOUR STUDENTS understanding of matching items in the world around them, verbal and listening skills, English language and vocabulary development.

- LARGE YET COMPACT: Will fit in your pocket! Comes with a wide selection of recognizable, everyday objects. Create games and promote easy learning out of the 5 starter teaching games!

EazyHold Silicone Adaptive Aid (12 Years to Adults) for individuals with Limited Hand Mobility, Cerebral Palsy, Stroke. Perfect for occupational therapy or physical therapy use (Lavender – 5 1/4″- 2 P

- VERSATILE ADAPTIVE AID - Gives individuals independence for Writing, Eating, Grooming, Personal Care (Toothbrush, Hair Brush) , Daily Living and SImple Chores

- EXTRA SENSORY- Puts the tool in hand or limb and against the skin for better perception of the weight, vibration, temperature and texture of the object

- COMFORTABLE FIT - Made of soft strechy silicone which warms to skin temperature and does not need to be tight on the hand to support the item.

- MANY SIZES - EazyHold comes in 8 different sizes to fit infants, toddlers, teens, children and adults hands or limbs.

- EASY TO CLEAN - Wash with soap and water, the dish washer basket or in an autoclave. Will not degrade with repeated use of hospital disinfectant wipes.

EDsportshouse Sensory Toys Bundle-Stress Relief Fidget Hand Toys for Kids and Adults,Sensory Fidget and Squeeze Widget for Relaxing Therapy-Perfect for ADHD Anxiety Autism

- Package:this toys sets include 6 pack Mochi Squishies toys,2 wacky fidget,2 Strech Squeeze toys,5 Mesh& Marble fidget toys,2 soybean and 1 bike chain

- CHILD SAFE: Non-Toxic. Meets US Toy Standards. Safety Test Approved. Durable. Superior Quality. Deluxe Set.

- RELAXATION THERAPY: Our fidget toys are the perfect way to relieve stress - a small toy to hold in the palm of your hand. It's a fun way to keep the brain focused and the hands busy.

- Great design for anxiety, focusing, ADHD, ADD, autism, quitting bad habits, etc. Helps relieve stress. Get it and share it with your friends for a fun party time.

For adjustable interest rate mortgages, you will likely be able to select one of the five disbursement plans. The five plans are referred to as 1) Tenure, 2) Term, 3) Line of Credit, 4) Modified Tenure, and 5) Modified Term. You may be able to change your payment option for a small fee, as long as you have not drawn all of your funds already.

HECMs generally give you larger loan advance rates against the value of your home than proprietary loans[6]. The interest rate on HECM loans is generally lower, but you have to pay MIP amounts that you will not have to pay on proprietary loans. In the HECM program, a borrower is generally allowed to live temporarily in another residence (such as a nursing home) for up to 12 consecutive months without triggering a requirement to pay off the loan. You must continue to pay property taxes, insurance, and HOA fees while you have the loan, and you must continue to maintain your home, even if you are temporarily residing elsewhere

[6] The higher HECM advance rate means that a HECM loan is likely a better choice for borrowers who are seeking maximum loan proceeds and whose homes are worth more than the FHA lending limit of $636,150 but less than about $1,000,000. After that, borrowers will likely qualify for a larger loan under a proprietary program than the HECM program. Note that HECM loan rates are lower than those of proprietary loans, but also require MIP payments. If you have a high value loan, you or your accountant will need to study the competing costs and terms; your HECM counselor can help as well.

.

Amount You Can Borrow

The amount you can borrow with a reverse mortgage depends on several factors, including:

- The lesser of the appraised value, purchase price of your home, or the FHA mortgage limit of the HECM lending program

- The age of the youngest borrower or eligible non-borrowing spouse

- Expected interest rate at the time of origination

- An assessment of your willingness and ability to pay property taxes, homeowner’s insurance, and HOA fees as they come due

- The disbursement option and type of reverse mortgage you select.

In general, the older you are, the more equity you have in your home, and the lower the absolute amount you owe, the more money you can obtain. If there is a non-borrowing spouse, his or her age is taken into account due to rights of survivorship under the HECM program. If there is more than one borrower and no eligible non-borrowing spouse, the lender will use the age of the youngest borrower to determine the maximum loan amount.

Costs Involved

Like forward mortgages, reverse mortgages can have high levels of fees and charges. Upfront origination fees are capped by HUD for HECM loans; proprietary loans generally do not have such caps.

You can finance most of the upfront costs of your reverse mortgage, paying them from the proceeds of the loan. The benefit of this is that you do not have to pay for them out of your pocket. The drawbacks are:

- You are still incurring the costs and effectively reducing the net loan amount available to you

- You will accrue interest and MIP on the higher balance

If you pay the upfront MIP out of pocket, the amount paid may be tax deductible for you in the year paid.

The charges and fees for HECM loans are described in greater detail below. Other reverse mortgage programs may include other categories of charges and fees, and the fees may be higher or lower. You should carefully consider any charges and fees you will incur when deciding whether to obtain a reverse mortgage loan, as well as the category of loan and lender.

.

Personal Development Goals

Personal Development Goals

Bedrooms Designed for Aging in Place

Bedrooms Designed for Aging in Place Furniture

Furniture Kitchens Designed for Aging in Place

Kitchens Designed for Aging in Place Lighting and Light Switches

Lighting and Light Switches

Assisting With Functional Mobility

Assisting With Functional Mobility Bath and Shower Mobility Aids

Bath and Shower Mobility Aids Bedroom Mobility Aids

Bedroom Mobility Aids Assisting with Personal Grooming and Hygiene

Assisting with Personal Grooming and Hygiene Caring for Someone With Incontinence

Caring for Someone With Incontinence Helping People To Cope with Alzheimer’s and Dementia

Helping People To Cope with Alzheimer’s and Dementia Helping With Bill Paying

Helping With Bill Paying Home Cleaning Services

Home Cleaning Services Offering Companionship

Offering Companionship Providing Medication Reminders

Providing Medication Reminders Providing Transportation

Providing Transportation Running Errands

Running Errands

Burn Care

Burn Care Mental Health Rehabilitaion

Mental Health Rehabilitaion

Canes

Canes Chair Lifts / Stair Lifts

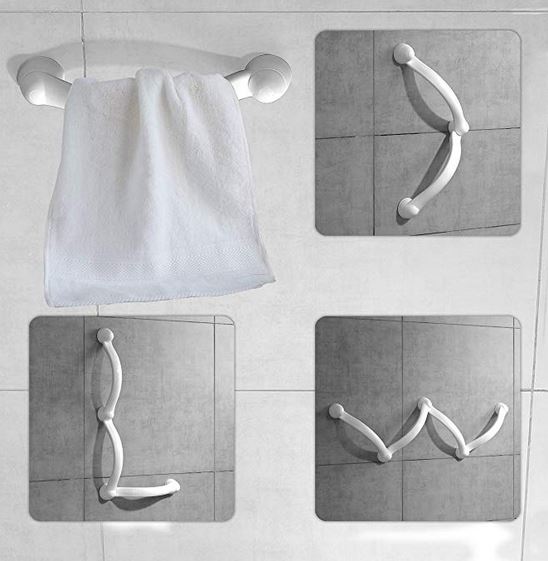

Chair Lifts / Stair Lifts Grab Bars

Grab Bars Knee Scooters / Knee Walkers

Knee Scooters / Knee Walkers Ramps

Ramps Scooters

Scooters Transfer belts / pads / equipment

Transfer belts / pads / equipment Walkers and Rollaters

Walkers and Rollaters Wheelchairs and Mobile Chairs

Wheelchairs and Mobile Chairs

Accounting and Tax

Accounting and Tax Books-Seminars-Courses

Books-Seminars-Courses

ASSISTED LIVING

ASSISTED LIVING Assisted Living Facilities

Assisted Living Facilities Cohousing Communities

Cohousing Communities Manufactured Housing Communities

Manufactured Housing Communities Naturally Occurring Retirement Communities (NORCs)

Naturally Occurring Retirement Communities (NORCs) Personal Residence LIving Independetly

Personal Residence LIving Independetly Accessory Dwelling Units

Accessory Dwelling Units Continuing Care Retirement Communities

Continuing Care Retirement Communities Multigenerational Households

Multigenerational Households